Click the following links to learn more about PC-Plod

|

|

Payroll & Bonuses

Payroll:

Weekly, Fortnightly, Semi-monthly, 4-Weekly, or Monthly Pay Periods Weekly, Fortnightly, Semi-monthly, 4-Weekly, or Monthly Pay Periods

- Hourly, Daily, Salary or Piece-rate, with or without Bonuses

- Majority of input direct from Plods – ensures invoicing is not overlooked

- ATO compliant for PAYG Pay Summaries (Group Certs), electronic Annual Report, etc.

- Option for “Expat Pays” where pay rates are after-tax:

- Can be whole-ledger or for selected individuals

- Allows for overseas flat-tax and slab-tax regimes

- Allows for foreign currency (eg: Pay in USD, tax in MZM (Mozambican Metical))

- Allows handling of Contractors as "employees" producing a Remittance Advice instead of a PaySlip

Bonus:

- Very extensive and flexible Bonus capability:

- Bonus paid in Period it is earned

- Production, Target and/or KPI bonuses

- Based on metres and/or chargeable hours and/or selected products

- Bonus rates/rules may vary by Classification, Employee, Job, Rig, depth

- Pay Bonus OR Guarantee, or Bonus PLUS Guarantee

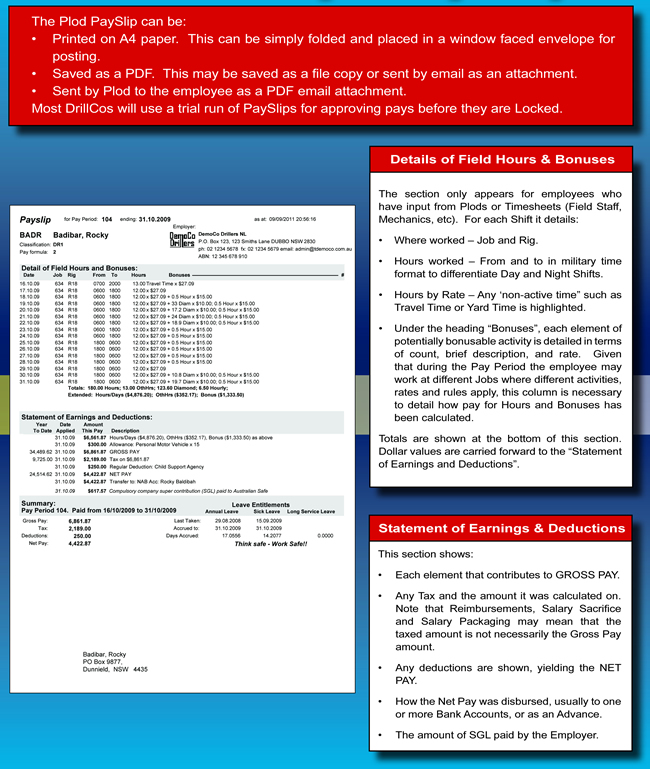

Pay Slips:

PayCalc: PayCalc:

- Pay individuals, All or Pay Groups

- Pays remain open and editable until finalised and Locked

- You can calculate and print any or all pays at any stage during the Period for management/enquiry purpose Plod Invoicings. Edit changes and re-calculate at any time prior to Locking.

- Where necessary you may Un-Post an invoice, add/alter/delete details, re-issue and re-Post it – with appropriate, balanced entries going to the General Ledger.

- Locking Pays produces electronic ABA file for transfer to your bank.

Disbursements:

- Employee may have multiple bank accounts

- Allows for Permanent and One-off Deductions

- Super:

- Allows for SGL, Salary Sacrifice, Additional Company and/or Employee Contributions, Salary Packaging.

- Super and deduction payments direct, or via a Clearing House

Allows for:

- Normal rates can be upgraded/downgraded for selected Shifts (eg: where DA works as Driller or vice-versa).

- Advances – Used where a driller bites you for $1,000 to tide him over till pay day.

- Reimbursements – Used where a driller paid company expenses out of pocket.

- Re-Hires – Employees who terminate and are subsequently re-employed will retain their old history.

All detail relating to pay, hours and employee production is retained for analysis purposes:

- HoursSniffer is a “data mining” tool that allow you to filter, select, and analyse detail at any level. By convention this detail will remain in the database for several years. Detail filtered can cover several years and may be:

- Exported to a .TXT file for further analysis and reporting/charting in Excel, Word, etc.

- Printed as a report using Plod’s FreeForm facility.

- Driller Analysis – Uses data filtered by HoursSniffer to give a comparative analysis of field staff production showing Drilling Type, Metres and revenue earned.

Reporting:

- Proforma Invoices – detail by Job/Rig in chronological order

- Invoices

- $ Shift Report – email to customer a priced report of activity for each Shift and Period to date

- Sales by Job – for selected Period(s)

- PlodTrans – a very revealing summary for management for selected Period(s)FreeForm – you can generate your own reports for your own purposes

Analysis:

- Entry Stats – Quickly see which Plods have been entered, and metres drilled at every Rig/Shift (as at 9:00am this morning if your guys are on the ball!)

- $ x Rig/Shift – Quickly see $ revenue for every Rig/Shift with totals and averages by Rig and Day (as at 9:00am this morning if your guys are on the ball!)

- Rig Usage – Which Rigs were doing what?

- PlodSniffer – see above

- PlodSniffAll – see above

Reports: Reports:

A comprehensive range of reports including Gross and Nett Pay Summaries, Allowances, Deductions, PayTrans, Super Lists, Accruals, PAYG reports, etc. can be previewed, printed as hard copies, or saved as PDFs.

Payroll integrates to:

- Costing:

- Payroll creates a detailed CostFile which is a balanced, fully costed general journal ready to export to your General Ledger.

- Apply Overheads: Will automatically cost and apply Workers Comp, Payroll Tax; and apportion SGL and Leave Accruals to the Jobs where work was done.

- Training: The Employee File has a portal to the Training sub-system which shows a colour-coded summary of each employee’s Training status.

- Performance: The Employee File has a portal that allows you to record and view an employee’s Performance History.

PayHours:

PC-Plod has an option where you may bypass PC-Plod’s payroll and produce a PayHours Report of Hours and Bonuses suitable for entry to a 3rd Party payroll.

More on Payslips:

|